The results of the highly anticipated 2022 BOMA International COVID-19 Commercial Real Estate Impact Study are now available, showing stabilizing views on workplaces and the commercial office sector after the last two and a half years of transformation. Drawing from the survey responses of more than 1,200 U.S. commercial office space decision-makers, the study also reveals that, despite perceptions to the contrary, employers and employees are equally supportive of hybrid work, with more than six in 10 members of each group wanting to be back in the office at least three to four days per week. With both employers and employees still seeing value in the physical workplace, this means commercial real estate has an opportunity to create even stronger partnerships with tenant companies to promote innovation and reinvention to shape the offices of tomorrow.

This is the third in a series of studies commissioned by BOMA International, underwritten by Yardi and developed by Brightline Strategies. To learn more about the study, read our press release. To request a full copy of the report, please contact [email protected] or [email protected].

Download the 2022 BOMA COVID-19 Impact Study Executive Summary

Dive into the findings and learn what they mean for your property and the commercial real estate industry. BOMA International, Yardi and Brightline Strategies will be hosting a live online information session exploring the results of the study on October 6, at 2pm Eastern. Register now to attend!

Key findings:

- 86% of respondents affirm their in-person office is vital to operating their business, up from 78% in 2021.

- 72% say they would renew their lease if it were up today, up from 38% in 2021, returning to a pre-pandemic baseline and showing tenants have more clarity on their future space needs now.

- 76% said their employees and colleagues support returning to physical offices.

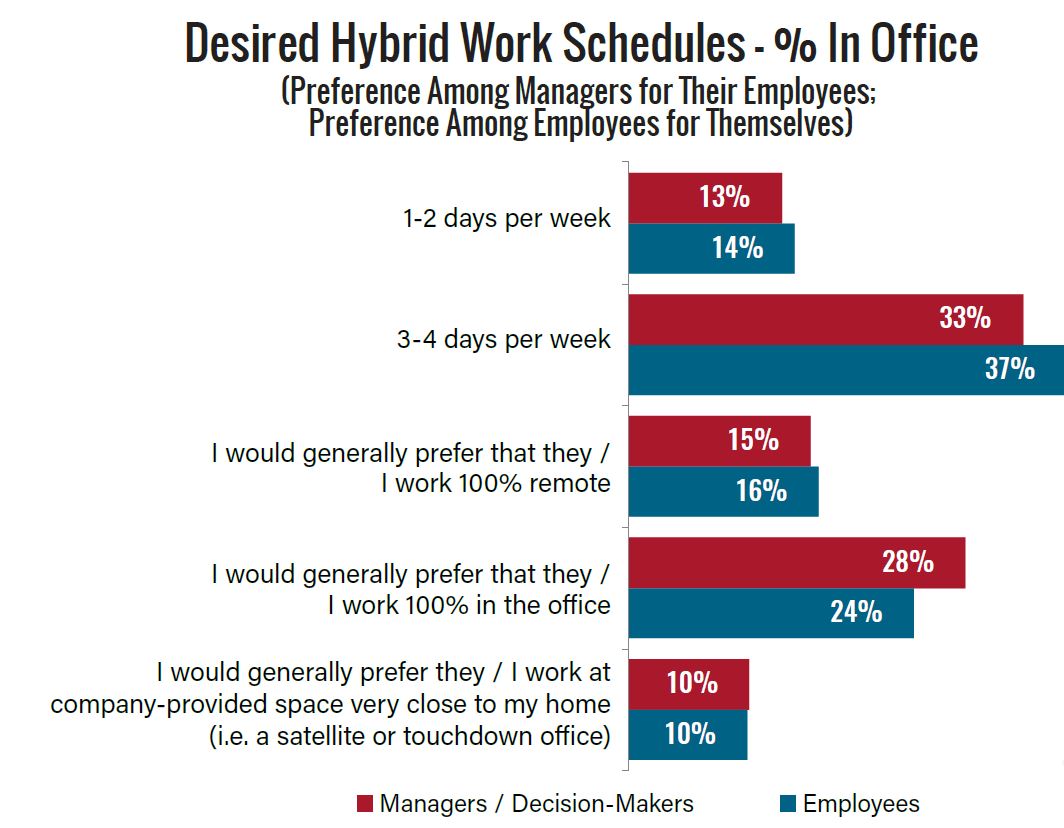

- Decision-makers predict, on average, that 29% of their employee base will be partly or fully hybrid/remote 12-18 months from now, similar to the 26% who said so in 2021. Still, two thirds would prefer that hybrid/remote work be limited to not more than 2 days per week.

- Almost two thirds of employers would prefer hybrid work schedules with at least three to four days in the office—a percentage that exactly aligns with the preferences of the employees they manage.

- The number of respondents across tenant sizes reporting they will reassess space needs (70%) has increased 15 points since 2021, indicating more certainty around potential changes. Among those respondents reassessing space, 61% would reduce their square footage, amounting to 51% of all office tenants surveyed (up from 37% in 2021). Notably, 36% of those reassessing would be expanding their square footage, amounting to 3 in ten tenants in the sample.

- 78% of tenants seek property owner or manager investments beyond the status quo in health and wellness amenities and programs designed to improve in-office collaboration.

Past Research:

2021 BOMA International COVID-19 Commercial Real Estate Impact Study

The results of the 2021 BOMA International COVID-19 Commercial Real Estate Impact Study reveal the transformational effects of the pandemic on the commercial office sector and tenant workplaces. Drawing from the responses of more than 3,000 U.S. commercial office space decision-makers, the 2021 study, which was fielded from March to May of 2021, reveals a growing optimism around the return to the office, mediated by tenants’ increasing clarity around the new normal of office and remote work practices. This is the second in a series of studies commissioned by BOMA International, underwritten by Yardi and developed by Brightline Strategies. To learn more about this study, click the cover image to download the executive summary and read our press release.

2020 BOMA International COVID-19 Commercial Real Estate Impact Study

While COVID-19 continues to be a disruptive force for the office sector and its occupiers, the perceived value of the office as a key ingredient of business success remains strong. That is one of the major takeaways from this first groundbreaking, nationwide study of more than 3,000 U.S. office space decision-makers commissioned by BOMA International, underwritten by Yardi and developed by Brightline Strategies. The study, fielded from September 1 to October 31, 2020, was designed to assess the latest in tenant sentiments relating to the pandemic, as well as its impacts on their businesses, attitudes towards the physical work environment and office space decisions going forward. The findings provide a clear picture as to the pandemic’s broader transformational effects on the office sector and what measures owners and operators can leverage to mitigate downstream risk. To learn more about this study, click the cover image to download the executive summary and read our press release.