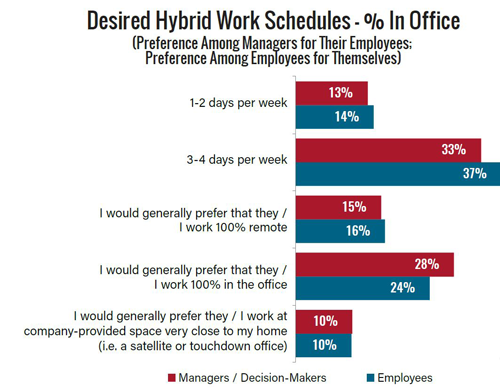

As the study indicates, hybrid work strategies are not shaking out to be an all-or-nothing concept, though they can’t be entirely ignored. The majority of decision makers (61%) and the teams they manage (60%) see at least three to four days in the office as optimal. Only 16% of survey respondents would support a total remote work approach.

The implications here for the value of the office are clear, and they are reflected in the survey results, with a striking 85% of tenants indicating the office is vital to a successful business—an 8% jump from the spring 2021 results. This recognition of value, while shared by tenants of various sizes, seems highest among class A occupiers (90%) and those holding more than 5,000 square feet. It dips a bit—to 79%—for smaller tenants, but clearly remains the majority view.

What can corporate tenants gain from an office presence that they cannot in remote environments? A “place for interactions with clients and customers” is key for 78% of respondents; for 76%, it’s the ability to “promote company presence and brand in our markets.” Rounding out the top five reasons are the ability to:

- “Support learning and continued training” (75%);

- “Support co-creation for innovation and new ideas, with space and technology to work together” (also 75%); and

- “Promote our organization’s culture and values” (74%).

The corollary to office value, of course, is leasing strategy, and the 2022 survey reveals that renewal intentions, as expressed by 72% of respondents, is close to pre-pandemic levels. But 54% will re-up for shorter terms, from three to five years, rather than seven to 10.

It is important to note here that, after more than two years of creating COVID-19-related office safeguards, the pandemic is no longer the top issue influencing the influencers. Not surprisingly, 81% of survey takers now point to inflationary pressures as top of mind. Lasting COVID-19 health concerns, while still important, are overshadowed by challenges such as business dynamics, macroeconomic factors and managing the shift to hybrid and telework protocols.

But safety protocols nevertheless remain a concern, evidenced by the 76% of respondents who support hand sanitizer availability and ongoing disinfection; the 73% who want continued integration of fresh air into HVAC systems; and the 65% who favor health-promoting technologies such as touchless elevators.

The combination of post-COVID health concerns and other, more recent corporate concerns creates challenges and opportunities for tenants and property managers alike. In the ongoing effort to make the office an enticing place for employees to be, more tenants today (78% as opposed to 64% in 2021) are seeking amenities “beyond the status quo.”

And with a nod toward meeting the conditions under which reluctant employees would return to work, there are five key adjustments to space usage that tenants either have, or would enact alone or in conjunction with their property managers. They are:

- Holding more professional development events (85%);

- Working with property managers to make buildings, common areas and other amenities more welcoming (83%);

- Hosting more social events (81%);

- Offering stipends for commuting workers (80%); and

- Replacing private offices with more touch-down and team-building huddle spaces (78%).

Amenities to Attract Employees

Amenities to Attract Employees

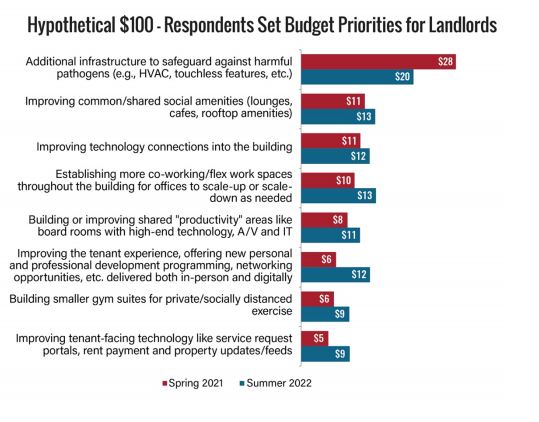

Moreover, given a hypothetical $100, corporate users would want their property managers to spend $20 on additional infrastructure to safeguard against harmful pathogens. They would allocate $13 to improving common/shared special amenities such as lounges, cafes and rooftop amenities and $12 for improved building-wide technology connections. By comparison, those allocations last year were $28, $11 and (once more) $11, respectively.

Clearly, concerns over health and safety that were born of (or accelerated during) the COVID-19 pandemic still influence workplace decisions of corporate tenants around the U.S. Add to these new concerns, such as strategizing through the current economic condition, and it becomes clear that a new relationship is emerging between tenants and their office space.

Therein lies the challenge for property managers and owners. Of course, with new challenges come new opportunities for engagement and partnership.

To read the full survey report, please visit www.boma.org/covidimpact.

ABOUT THE AUTHOR

John Salustri is editor-in-chief of Salustri Content Solutions, a national editorial advisory firm based in East Northport, New York. He is best known as the founding editor of GlobeSt.com. Prior to launching GlobeSt.com, Salustri was editor of Real Estate Forum.