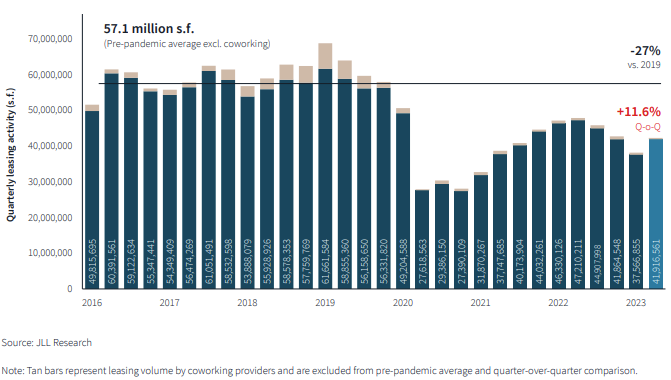

JLL is also expressing some optimism over the market’s promise, stating that “After three consecutive quarters of decline, US office leasing has begun to rebound in the second quarter, with gross leasing volume growing 11.6% quarter-over-quarter (QoQ).” The firm calls it the fastest growth rate since Q2 2021. Nevertheless, “Net absorption remains negative.” But JLL sees a coming inflection point in absorption, and “the rate of decline slowed 40% from the over-20 million sf of negative net absorption in Q1.”

As BOMA International proved last year in its

Occupier Survey, the office is still a major player in the growth—as well as the collaborative and social dynamics—of American commerce. And, in these early post-pandemic days, corporations are still trying to figure out their relative stances on remote and in-office work.

“Despite the prevalence of remote and hybrid work arrangements coupled with the pandemic-induced decline in office usage, our latest U.S. office market report confirms that return-to-office trends persist well into 2023,” states CommercialEdge in its

September National Office Report.

We can add to that office imperative a new—and somewhat disconcerting—revelation, this from Gallup. Its research reveals that employee loyalty was never very high, even before the pandemic, a direct reflection, it said, of management’s inability to lead and motivate. Post pandemic, however, with the full flowering of hybrid work, “The percentage of engaged employees in the U.S. in mid-year 2023 is now 34%, up two percentage points from 2022.” Not exactly a stellar uptick.

But wait.

There’s more. Employees who can do their work remotely have “an eroding connection to the mission or purpose of the organization.” There is an all-time low of 28% of exclusively remote workers reporting that they feel “connected to their organization’s mission and purpose.”

So, the need for an office presence remains clear. But not so much its mid-term future. As CommercialEdge senior manager Peter Kolaczynski explains in the firm’s report, “Even as some form of hybrid work becomes ingrained and accepted, the lack of overall physical office usage continues to push tenants to smaller footprints. More folks being in the office year-over-year is still not comparable to what usage was pre-COVID-19.” He points to vacancy rates that continue to rise “as leases expire.”

In fact, the report pins the current vacancy rate at 17.5%, a year-over-year (YOY) hike of 260 basis points (bps). Further, the average US office listing rate dropped 2.2% YOY, to $37.83.

So, taking the longer view does not necessarily brighten the mid-term picture for the office market. But the strength of the office as an additive to business success remains powerful, and on this score, Ernst & Young aligns itself with BOMA International.

What does a business--and its teams—gain by leaving the kitchen table and getting back to the office?

Let EY count the ways:

1)

Employees benefit from the culture of the organization. “Organisational [sic] culture has a proven influence on business performance,” says EY, “particularly revenue growth, net income, productivity, employee absence, creativity and employee retention.”

2)

Work/life balance. “By having a clear ‘place of work’, one can physically leave it and draw a line under that part of the day,” says the firm.

3)

The quality of the environment. “In an office, you are guaranteed certain standards by law: suitable equipment for your job might include chairs that support your lower back and screens that don’t strain your eyes. There is also legislation that demands workplaces maintain appropriate working conditions, such as temperature.” All of this above and beyond the amenities decision makers feel are required for the culture of their workplace.

4)

Relationship building. “Being in the office allows employees to connect with people they may not interact with daily,” says EY. “These spontaneous conversations over coffee or while passing in a corridor are hugely valuable.”

Yes, there are still miles to go before the uncertainty of new hybrid work protocols are ironed out, and maybe as miles more as we wait for the economy to iron itself out. When all that does happen, the tea leaves point to a renewed understanding of the power of the office for business, its culture and its people.

ABOUT THE AUTHOR: John Salustri is editor-in-chief of Salustri Content Solutions, a national editorial advisory firm based in East Northport, New York. He is best known as the founding editor of GlobeSt.com. Prior to launching GlobeSt.com, Salustri was editor of Real Estate Forum.