To paraphrase Mark Twain, the death of the office has

been greatly exaggerated. New research confirms that,

despite the havoc wreaked this year on the sector by the pandemic,

the office remains a key ingredient of business success,

and the role of property managers remains critical.

Breaking through the noise of buzzy headlines, the latest

verdict comes from the tenants themselves. It’s found in the

responses of the more than 3,000 U.S. office space decision-makers

who participated in a groundbreaking national study

commissioned by BOMA International, underwritten by Yardi

and developed by Brightline Strategies. The just-published

BOMA International COVID-19 Commercial Real Estate Impact Study examines the impact of the pandemic on office tenants

and provides a clear picture of the transformational effects of

COVID-19 on the office sector.

Not only did the study verify the long-range role of

the office as a pillar for business success, it underscored

the support of building owners and managers—which

continues through the depths of the pandemic—as an

essential business asset. That’s not to say, however, that

tenants and managers alike aren’t faced with COVID-19

challenges, and the survey brought those challenges into

high relief as well. But, proactive property managers

won’t leave those challenges unanswered. Therein also

lie ample opportunities to enhance their relationships

based on defined need.

THE OFFICE WORKS

There’s no doubt about the future of the office. Nearly three-quarters

of surveyed tenants—and 77 percent of C-suite

executives and business owners—report that the office is vital

to conducting a successful operation.

Building managers also get high marks, with 78 percent of

respondents approving or strongly approving of how their

building teams responded to the health crisis. Contributing to

that score were their communications methods—with 79 percent

saying landlords reached out “just the right amount.” And,

clearly, the communications needn’t be elaborate or costly for

building managers to score a big win. The method of choice

was email, favored by 63 percent of tenants, with some sort of strategy guide and in-building signage coming in second and

third. Lower down on the list of preferred outreach methods

were quarterly video calls with building managers, as well

as prerecorded videos and webinars or “town halls,” none of

which were capital-intensive solutions. Those high marks

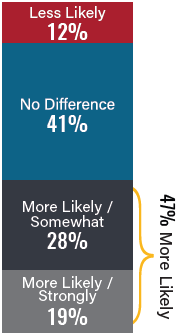

move directly to the bottom line, and 47 percent of respondents

say that, based solely on building managers’ responses

to COVID-19, lease renewals are somewhat or very likely.

By comparison, pre-COVID, 55 percent of surveyed tenants

would renew if their building teams focused on communications;

investments in advanced processes and technologies;

and, on the softer side, relationships (46 percent see more

value in a personal relationship with their property managers).

That score jumped to 66 percent post-pandemic.

MORE WORK LEFT TO DO

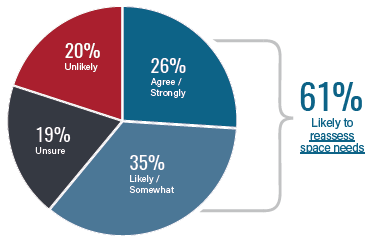

At 66 percent, renewals are clearly not a slam-dunk, and nearly

as many tenants—61 percent to be exact—plan on some

reassessment of their space needs. And, of those, 54 percent

either are planning to cut back on their square footage or are

unsure. Thirty-three percent would either expand their spaces

or stay put.

If (or when) space users make their cuts, where will they

happen? The winner—or loser in this case—was common areas,

voted by 36 percent of respondents. It was also the number

one choice of all occupants when segmented by the size of

their holdings. Drilling down more, tenants suffering low 2020

revenues outweighed their high-revenue counterparts in their

eagerness to cut common areas (43 percent of lower-revenue

responses compared to 30 percent of higher-revenue firms).

Reducing the size of private offices came second at 28

percent and reducing the number of private offices placed

third at 27 percent. Rounding out the top five, a reduction in

conference room size was selected by 27 percent. Only then do

we start to see changes in working protocols, with 25 percent

of respondents eyeing adoption of hoteling or flexible work

desks for teleworkers. It should be noted that, in this age of

high single-digit unemployment, a relatively low 23 percent

of respondents are considering cutting their workforce. Not

surprisingly, most of these are lower-revenue firms.

Impact on Renewal

Q: Have your property manager or landlord's responses

to COVID-19 made you more likely to renew your lease?

What’s driving these space decisions? Also not surprisingly,

cost (34 percent); location and proximity to clients, customers

and employees (31 percent); and safety and security (25

percent). These three rank the highest (or second highest) by

tenants responding to the survey.

Herein too reside opportunities for building managers to

enhance their relationships and, possibly, their renewal rates.

Homing in on tenant needs for space cuts, working with them

to develop solutions and communicating to them your safety

and security strategies all send a clear message of proactivity

on their behalf.

There’s a fairly tight cluster of responses around new protocols

occupants plan to put in place, whether or not they’re reassessing

their space needs. In the low-hanging-fruit category,

80 percent of respondents plan to enforce the universal use of

face masks. Seventy-four percent will enforce occupancy limits

in common areas, and 65 percent plan a staggered return-to-work schedule.

MAKING SENSE WITH THEIR DOLLARS

With cost concerns high on tenant radars, how much of an

impact would those space cuts have on their bottom line?

Forty-seven percent envision increases, while 35 percent

would still suffer revenue losses. Eighteen percent expect no

change in their revenues, 24 percent of whom are tenants of

1,000 to 5,000 square feet. As a generalized statement, more

larger space users tended to reap revenue improvements as a

result of their post-COVID cutbacks than smaller firms.

In terms of the perceived value that certain building-provided

protocols and products could bring, the survey highlighted

five and linked to them the number of tenants who would

pay a premium for them. The Big Five (in descending order

of rank) were: maximized fresh air (37 percent); the installation

of large and prominent disinfection stations (21 percent);

twice-daily full sanitization with chemicals and ultraviolet treatment (17 percent); additional front-desk staffing to ensure

safety policies (13 percent); and an on-site health and wellness

advisor (11 percent). No fewer than 33 percent of respondents

checked the “would pay a premium” box in any of those five

categories. The top-rated fresh air/heating, ventilating and air-conditioning

(HVAC) concern ranked highest in the premium

question, at 47 percent of respondents.

Q: How likely are you to reassess your space needs based on business impacts from the coronavirus?

It’s interesting to note that 49 percent also indicated their

interest in more flexible, shorter lease terms, while 42 percent

desired longer terms with clauses that speak to health.

Of those who are reassessing their spaces, there are a few

other areas, either paid for or complimentary, where building

managers could pitch in (presumably with the previously mentioned

benefits to renewals). These are access to vacant spaces

for social-distancing purposes (71 percent); building out dedicated

teleworking rooms and office relocation services (52 percent);

and providing relocation services (62 percent). However, the

perceived level of employee comfort provided by each of these

provisions never ranked below 50 percent.

THE VALUE PROPOSITION

Arguably, it is here that the light property managers bring to the

chaos of COVID-19 shines most brightly. When asked about the

investments property owners and managers are making in the

physical features and infrastructures of their assets in the name

of tenant safety, the score is a fair 65 percent, but with about 35

percent of respondents holding off, either unsure (27 percent)

or seeing no value (8 percent). What’s more, 62 percent of office

tenant respondents recognize the importance of their physical

environments for facilitating the human connections that contribute

to productivity and then, by extension, the most successful

businesses.

As BOMA International continues to unpack the results of the study, both on a

national and regional basis, it becomes clear that property managers

have more work to do to close the gap in tenant relationships.

But, it is equally clear that the most proactive building

professionals are taking the lead in the items they can control,

communicating their concern and involvement in the health, safety

and productivity of their tenants.

About the Author: John Salustri is editor-in-chief of

Salustri Content Solutions, a national editorial advisory firm based

in East Northport, New York.