In the past decade, the once novel ideas of coworking and other flexible space arrangements have moved from niche to mainstream. In the United States alone, the flexible space footprint has grown at an average annual rate of 22 percent since 2010, according to JLL research. Following the disruption of the pandemic, demand for flexible space is likely to grow yet again. The future of commercial real estate lies in flexible space—in all its variations—and owners and investors will shape that future.

From a customer’s point of view, flexible space has a lot to offer. Around the world, companies are using coworking and flex-space arrangements to support an increasingly mobile workforce and bolster organizational agility with shorter, variable lease terms. According to JLL’s most recent Occupancy Planning Trend Report, more than half of responding companies have incorporated coworking spaces into their real estate strategies

Who's Flexing Where?

Accounting for 10 to 20 percent of leasing activity in many markets in 2019, flex space grew from a marginal business sector to a key pillar of growth in most global gateway cities over the past decade. By 2019, the top 20 markets across the Americas; Europe, the Middle East and Africa (EMEA); and Asia-Pacific (APAC) recorded a combined flex inventory of around 204 million square feet.

This astonishing growth slowed in Q4 2019, with most cities around the world recording just a handful of new coworking transactions. In New York City, for instance, flexible space leasing declined 84 percent year-over-year. In addition, the entrance of new flex-space operators slowed as investors pulled back. Meanwhile, some landlords looked to mitigate risk by capping long-term leases with flexible space operators within their portfolios. They also started getting into the game themselves by creating their own flex offerings within their buildings or partnering with white-label providers.

Appeal to Corporate Occupiers

In the pre-pandemic era, many companies saw flexible space options, including coworking, as a way to win the amenities race and support such workplace experience goals as employee engagement, health and well-being. In fact, nearly half (48 percent) of commercial real estate professionals across the globe highlighted the flexibility and agility of their real estate portfolio among their top three human experience goals, according to JLL’s 2018 Future of Work Survey.

While coworking was initially an option primarily for freelancers, start-ups and small businesses, large companies could account for 40 percent of coworking revenue before the pandemic. As companies tackle the next normal, the need for an agile portfolio with a spectrum of space options has only increased.

According to the previously mentioned occupancy report, flexible space comprises no more than 5 percent of the average global corporate real estate portfolio—for now. However, in The Impact of COVID-19 on Flexible Space (pictured, above), JLL predicts that the pandemic will accelerate demand for flexible space given the need to de-densify workplaces. In fact, 30 percent of all office space will be flexible in some form by 2030—and large corporate occupiers will be driving much of the demand.

As of right now, many organizations continue remote working while prioritizing social distancing and other health and well-being measures in the workplace. Some are adopting rotational work shifts to limit office occupancy at any given time. Flexible space can support these measures, enabling a company to expand its footprint temporarily while adding convenient work locations for employees. Building owners and investors with available space have an opportunity to help meet that need alongside coworking operators.

The growth of flexible space won’t happen immediately but, rather, in phases as organizations refine their reentry strategies. So, what will the next six to 24 months look like for the sector? Let’s take a look.

Near Term in the New Normal

Not surprisingly, flex-space providers, just like almost everyone else, have incurred some losses this year. Tenant priorities have shifted to employee health and well-being. Where traditional corporate offices have been virtually deserted during the pandemic, so, too, have short-term offices, flexible spaces and coworking centers, ultimately testing the sustainability of some flexible space commercial models.

In some instances, government-based public health guidelines mandate 6-foot social distancing. In addition, some operators have instituted more complex requirements for booking space, temperature checks, health questionnaires and protocols in the event of an office outbreak, creating necessary obstacles to usage. Combined, these factors also have led to reduced occupancy and the loss of the dynamic, energized environment that is often part of the appeal of shared workplaces.

Of course, profitability in typical coworking spaces has been driven by high seating density and rental arbitrage. Coworking operators that are dependent mostly on freelancers and startups will continue to face the toughest test as their core users opt to work from home.

Simultaneously, large corporations are shedding memberships for quick cost savings. However, flex-space operators with a hybrid business model that combines short-term users with long-term commitments to private office spaces are better positioned to survive. Some green shoots are already starting to emerge as workers, tiring of working from home, begin to seek out flexible space options. This is particularly evident in suburban office locations.

Consolidation among flexible space operators had begun before COVID-19 and, as with many other trends, it is likely to accelerate due to the pandemic. Some property owners and investors will be affected significantly by the loss of these tenants, adding to growing vacancies in their assets. In turn, opportunistic operators or investors could take advantage of this market consolidation as owners begin looking to reuse the space.

Some of the larger, well-capitalized flexible space operators will restart their expansion drive, picking up assets and market share from those unable to weather the storm. The result...will be the creation of a greater handful of well-financed, profitable regional operators to support employee expectations and provide agility to respond to business change.

Ongoing Transformation

As the workforce continues its return to the office, business continuity and operational resilience will come to the forefront for tenants as strategies for remote working and de-densification continue. Among corporate occupiers, 67 percent are already incorporating flexible space as a central element of their agile work strategies, according to JLL’s report.

Operators that can withstand the challenge of the pandemic will look to support all users, regardless of size or sector. In fact, some proactive flexible space companies already are attempting to drive brand loyalty through remote community services.

The aforementioned increase in workplace mobility programs will continue to reduce density in both traditional and flexible offices. Tenants will turn to flex space to house small satellite offices close to employees’ homes, reducing commute times and dependence on public transportation. Continuing economic uncertainty will motivate corporate occupiers to reduce their portfolios and pursue other cost-saving strategies.

Owners whose properties are significantly affected by the loss of flexible space operators or space closures will look to repurpose their vacant offices and potentially operate their own flex spaces—as some had done before the pandemic. And, just as before, others will hire flex-space operators as managers for landlord-operated flexible spaces.

More Than A Perk

Clearly, the pandemic has challenged the role of the office. The mass experiment in remote working has reinforced the need for a communal space that supports collaboration, innovation and company culture and enables high-performance teams. The vision of the workplace as more than simply a place to work has led companies to focus on providing technology-enabled, experiential workplaces for collaborative meetings with clients and employees. Employers across the country are assessing whether a fixed, permanent workspace is a daily necessity for employees. Even before the pandemic, the 2019 IWG Global Workspace Survey from International Workplace Group found that four out of every five employees would, given two similar job offers, choose the one that offers flexible working. Such a choice is now an expectation and no longer seen as just a perk. These employee preferences could further push enterprises to more agile real estate solutions and, perhaps, lead to less demand for long-term leases or owned assets.

A mix of traditional and flexible space will be even more important in corporate real estate portfolio strategies in the future. Having learned the price of inflexibility during this pandemic, many organizations will build agility and resilience into their corporate real estate strategies. JLL research predicts that many will add flexible spaces for the ability to expand or shrink the footprint as necessary—and they’ll expect their landlords to offer flex as an amenity to address business change as well.

The focus on health and well-being will only increase in the future since, as experts predict, the current pandemic will not be the last. Following a decade of office densification, many companies will hesitate to return to high-density workplaces after de-densifying in response to the pandemic. Flexible space arrangements will be a useful option as companies navigate the path to right-sizing their office spaces and occupancies.

Some, but not all, coworking operators will survive the pandemic. As previously mentioned, after the initial wave of uncertainty has passed, some of the larger, well-capitalized flexible space operators will restart their expansion drive, picking up assets and market share from those unable to weather the storm. The result of this consolidation will be the creation of a greater handful of well-financed, profitable regional operators to support employee expectations and provide agility to respond to business change.

These providers may be attractive to building investors and tenants alike. Large organizations, rather than freelancers and startups, are likely to drive this activity, driven by their unwillingness to commit to large capital expenditure projects and, therefore, opting for prebuilt space and lease flexibility.

Most important for owners and managers, flexible space operating models will undergo a significant shift. The move by building owners and investors to operate their own flexible spaces within their portfolios will only continue. Rather than leasing space to operators, risk-averse landlords will turn to fee-based flexible space management arrangements—including white-label arrangements—to manage their flexible space. Moving forward, we expect a shift away from self-perform to operational partnerships.

For property investors, the self-perform approach provides the opportunity to leverage unused space and appeal to tenants while creating an additional revenue stream. By meeting tenant demand for convenient flexible space, building owners and managers can drive immediate and long-term value for their assets. If they don’t, their competition will.

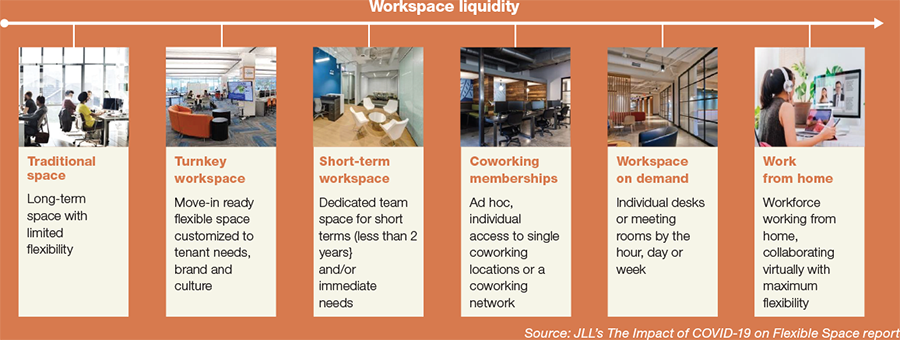

Clearly, flexible space is here to stay. However, the concept has evolved from coworking centers into a spectrum of options addressing different needs (see "The Spectrum of Flexible Space," above). Whenever this now-resurgent pandemic recedes, tenants and landlords alike can expect to see a myriad of choices emerging in the marketplace to provide new levels of real estate flexibility and employee experiences. Building owners and managers will be on the frontlines in creating the future of flexible real estate.

The Spectrum of Flexible Space

While the rise of WeWork brought coworking into the limelight, a spectrum of flexible space options has taken shape, ranging from on-demand workspaces and coworking memberships to short-term, flexible spaces and traditional space consumed through short-term arrangements. Creating still more drama in the market, some building owners and operators have entered the waters, creating their own flexible spaces for tenants needing swing space or short-term project space.

About the Author: Ben Munn is managing director and global flexible space lead at JLL.